Quantconnect vs Composer: How do they compare?

The key differences between QuantConnect and Composer

What are the main differences between QuantConnect and Composer?

As much as 78% of all trades (according to the SEC) are executed by stock trading algorithms. Two of the most popular platforms to deploy stock trading bots include QuantConnect and Composer. While both platforms have their advantages and disadvantages, I've outlined some of the key differences to help you make an informed choice if you are looking to create your own stock trading bots.

QuantConnect (quantconnect.com) is a platform for algorithmic trading and quantitative finance. It offers a cloud-computing based environment for designing, testing, and deploying trading strategies through coding in various programming languages such as Python and C# and connecting to the environment via an API. Users can access historical and real-time market data, along with a range of financial indicators. The platform supports live trading integration with major brokerages.

Composer is also an algorithmic trading platform to create stock trading bots but the big difference is that no coding is needed. You can build trading algorithms (with the help of an AI assistant and no-code editor), backtest with professional grade data, and deploy in minutes. Composer is built on top of the Alpaca Markets brokerage. This means that they create a separate brokerage account to prevent your manual trading disrupting your automated trading.

I've separated the key differences in this short article below:

User Interface & Platform Access

Both platforms have a very different value proposition.

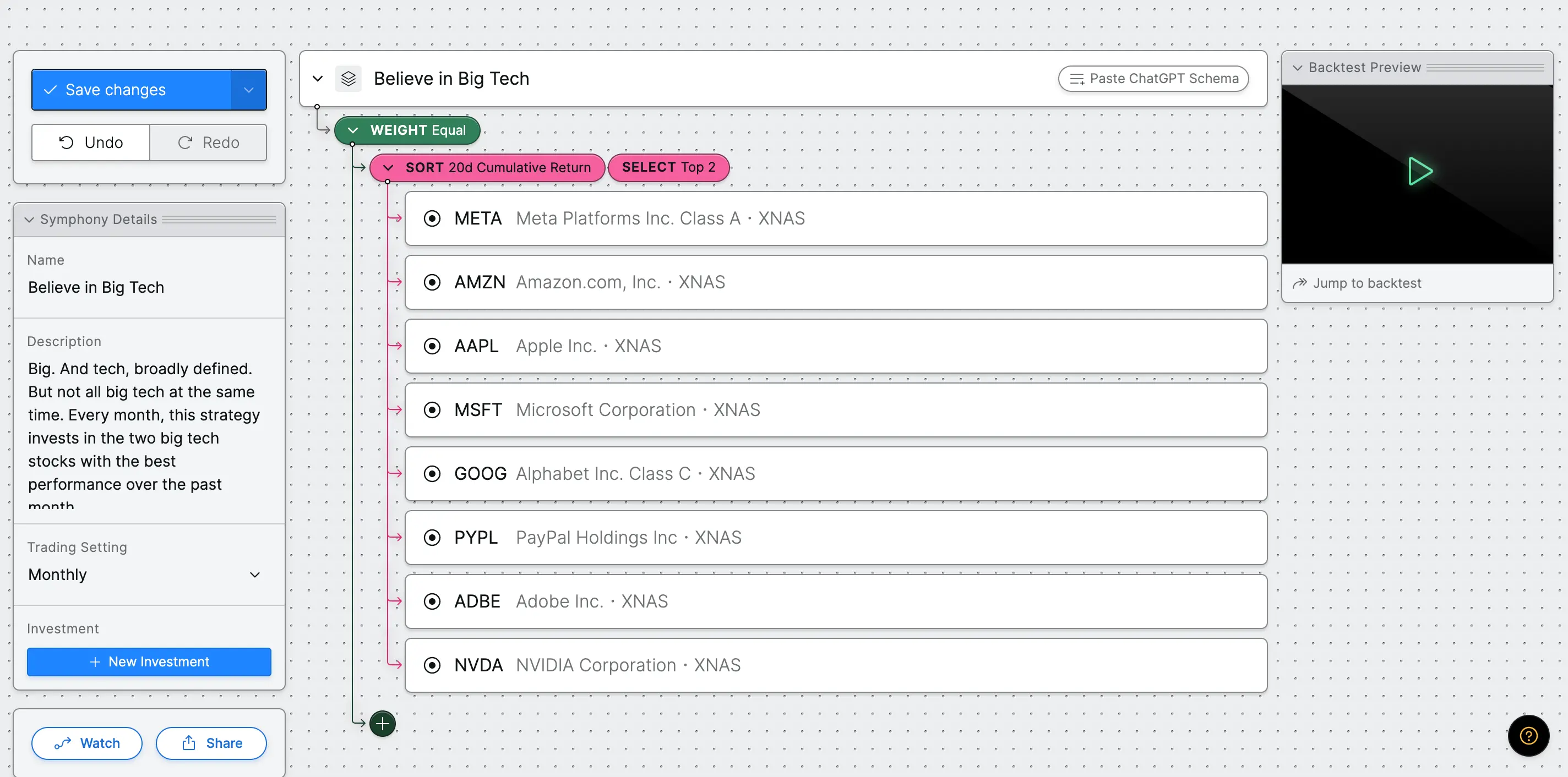

Composer is a desktop focussed app that lets you use the large screen size to build strategies in a visual editor and backtest with professional grade data and graphs directly in-app. The visual editor provides an easy way to understand the logic behind your strategy and enables both beginners and advanced users build their own stock trading algorithms. Composer also has a Discover page if you’re looking for pre-build stock trading bots or if you want to access 1k+ free strategies built by the community. You can trade like the greats (e.g. Warren Buffett, Ray Dalio) and even amend these strategies as you wish. Note: Composer also lets you login via mobile if you wish you check in on your investments.

QuantConnect is focussed solely on traders (quantitative developers and researchers) with programming knowledge. Their “Lean Engine” is an open-source algorithmic trading engine built for easy strategy research, backtesting and live trading. The core of the LEAN Engine is written in C#; but it operates seamlessly on Linux, Mac and Windows operating systems (you can find the open-source github repo here). QuantConnects API let’s you take your python, C#, or other code and then deploy it from your IDE into a cloud environment. One disadvantage is that you will need to ensure your code runs smoothly and you’ll need to debug it whenever there’s an issue.

Pricing

Pricing is one of the most important factors to consider when setting up a stock trading bot. If you already have a code script of your algorithm and you are comfortable programming, QuantConnect may be the more suitable choice. For $8 per user per month, you get access to their Quant Researcher plan which allows you to live trade in a variety of markets (including some brokerages that offer crypto) . QuantConnect also includes tick and second level financial data feeds. You can also pay extra for future and alternative data source feeds.

Composer Pro charges a fixed fee of $24 per month (paid annually) or $30 per month (paid monthly) to create an unlimited number of automated trading bots. This also provides you with access to professional grade data to backtest with, an AI assistant to help you build your own strategies, real-time portfolio metrics, and weekly performance updates to keep a track of your investments. The big difference between the two platforms is that Composer offers much greater flexibility to customize trading bots based on your needs.

Brokerages & Deposit Security

Composer Securities LLC is a registered broker-dealer with the SEC and a member of FINRA / SIPC, and automatically creates an Alpaca brokerage account for you. This means you have exactly the same level of security with $500k in SIPC insurance.

QuantConnect on the other hand connects to your existing brokerage account (e.g. Interactive Brokers, Alpaca, TD Ameritrade etc.) . This means you need to check with the brokerage to understand your deposit security.

Asset Choice & Transaction Types

QuantConnect supports a wide range of asset types, including equities, forex, options, futures, CFDs, cryptocurrencies, indexes, and commodities. This allows users to develop and implement algorithmic trading strategies across diverse financial markets.

On the other hand, Composer focuses solely on US stocks and ETFs.

Both platforms offer the choice to test the platform risk-free. While QuantConnect offers a paper trading brokerage, Composer offers the ability to ‘watch’ strategies with a simulated $1000 that you can track over time and measure out-of-sample performance. In both cases, you can get an indicative performance of your bot without depositing funds.

AI functionality

Both platforms offer AI functionality in different ways.

Composer has recently introduced ChatGPT4 AI copilot to supercharge the investing process. Using ChatGPT you can create strategies from scratch by ask questions and telling the AI assistant what you want For example: Can you create a retirement strategy with a focus on long term bonds and gold? What are the risks of this strategy? What should I add to diversify this strategy? What type of strategy would be a good complement to this one? You can check out more details here.

QuantConnect doesn't have direct AI functionality, however if you have some domain knowledge in machine learning, you are able to implement an AI trading bot through code on QuantConnect.

Customer Support

Composer offers email, live chat, and zoom calls with the product team. This means you have direct access to help influence how the product is improved going forward.

QuantConnect also offers email support and phone consultations (phone support available to gold members). You can find more details here.

Final Remarks

QuantConnect and Composer have two very different value propositions. If you’re looking for a highly technical cloud platform that offers an API to live trade your coded algotrading strategies, then QuantConnect may be a better fit. If you’re looking for a no-code platform that let’s you build trading algorithms from scratch (without coding) as well as find pre-built strategies to invest in, Composer may be the better fit due to the flexibility.

Moreover, building strategies in Composer is a fun activity, and spending time doing so is a great way to get accustomed to how the no-code editor works.

As you do so, we invite you to explore the site and sign up for a free Composer account to get a first-hand impression of what our platform can do for you.

We'd be happy to have you on our side, and provide you with the best automated stock trading platform there is!

Important Disclosures

Investing in securities involves risks, including the risk of loss, including principal. Composer Securities LLC is a broker-dealer registered with the SEC and member of FINRA / SIPC. The SEC has not approved this message.

Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, Composer has not independently verified such information and makes no representations about the accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; Composer has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, as it was prepared without regard to any specific objectives, or financial circumstances, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not intended as a recommendation to purchase or sell any security and performance of certain hypothetical scenarios described herein is not necessarily indicative of actual results. Any investments referred to, or described are not representative of all investments in strategies managed by Composer, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see Composer's Legal Page for additional important information.