Titan Invest vs Composer: What are the differences?

The key differences between Autopilot Investment App and Composer

What are the main differences between Titan Invest and Composer?

Both Titan Invest and Composer offer hedge-fund like opportunities to retail investors. However, there are some significant differences between the two platforms.

Titan Invest is a retail investment management platform that enables you to invest in a variety of off-the-shelf wealth management products - 'Smart Cash', for bond investments, 'Automated', for a rebalanced basket of either stocks or bonds, 'Managed Stocks', for actively managed funds, and 'Alternatives', for third-party investment strategies.

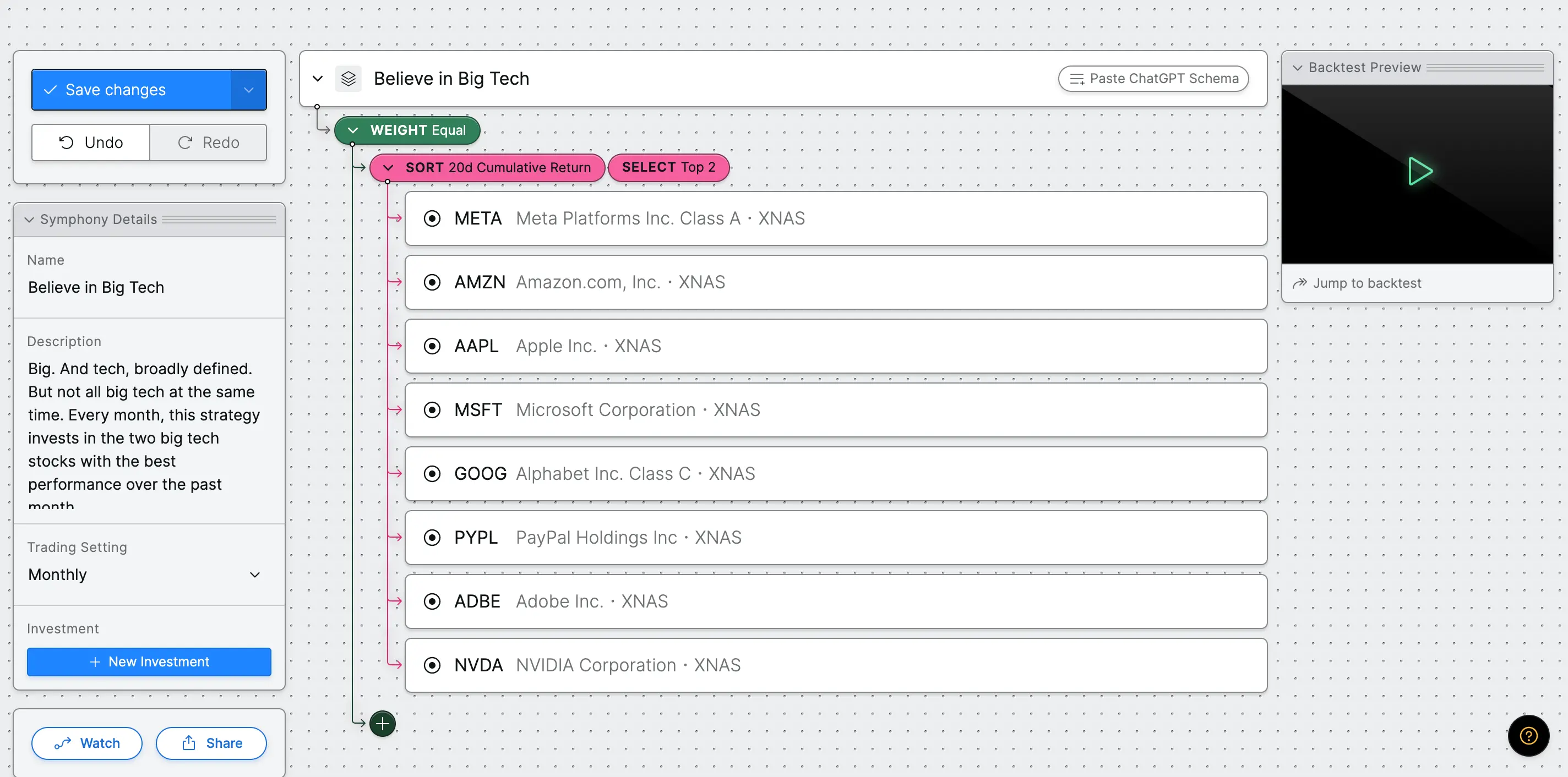

Composer on the other hand is the AI-trading platform that let's you build custom algorithmic trading strategies from scratch without any code. These strategies trade automatically for you and rebalance on the frequency you set. The closest resemblance to Titan Invest would be the Automated funds. However, unlike Titan, Composer provides you with fine-grain control to change the assets, and underlying strategy of what you invest in. Composer is not a robo-advisor but software to empower you to make personalized investing decisions through algorithmic trading.

Overall, Titan Invest and Composer have very different value propositions. Titan Invest sits in the bracket of robo-advisor wealth management platforms such as Wealthfront whereas Composer focuses on software to create algorithmic trading strategies with fine-grain control. Composer also let’s you invest in 1,000+ pre-built strategies in minutes like "Copy Warren Buffett", "Copy Ray Dalio" or "Copy David Swensen" from the Discover page.

I've separated the key differences in this short article below:

Asset Choice & Transaction Types

Currently, Composer offers access to a full range of US stocks and ETFs.

Titan Invest has a much wider variety of asset choices, however, unlike Composer, you don't have the ability to select individual assets but baskets of an asset type. Titan Invest has the following asset classes: Bonds (through it's Smart Cash product), Stock and bond ETFs (through it's Automated product), Stocks (through it's actively Managed Stocks product), and Alternatives (such as venture capital, real estate, credit, and crypto/cryptocurrencies).

User Interface & Platform Access

As mentioned previously, both platforms have a very different value proposition.

Titan Invest offers a desktop and mobile app (iOS/Android). This enables you to manage your investments from your phone. The interface is user friendly if you’re looking for an ‘on-the-go’ experience.

Composer is a desktop focussed app that lets you use the large screen size to build strategies in a visual editor and backtest with professional grade data and graphs directly in-app. The visual editor provides an easy way to understand the logic behind your strategy and enables both beginners and advanced users build their own stock trading algorithms.

The advantage of Composer is that you can see the logic that is being implemented, you can edit it using a no-code editor to personalize the strategy, and you can backtest with professional grade data to see how the strategy would have performed in different economic climates. Composer also lets you build trading algorithms from scratch - No coding is required to build a stock trading bot and there’s a simple visual editor and AI assistant to help you get started. Composer is built on top of the Alpaca Markets brokerage. This means that they create a separate brokerage account to prevent your manual trading disrupting your automated trading.

Note: Composer also lets you login via mobile if you wish you check in on your investments.

Pricing

Pricing is also an important factor to consider. The two platforms have very different value propositions so this isn't an apples-to-apples comparison.

For Smart Cash, Titan Invest doesn't charge a fee but the underlying treasury funds have expense ratios between 0.08%-0.34% at the time of checking.

For the Automated Basket of Funds, Titan Invest doesn't charge a fee but the underlying expense ratio is 0.039%.

For the actively managed portfolios, Titan charges fees based on assets under management. The Titan Flagship fund charges an advisory fee of 0.9% AUM per year (<$25k deposits), 0.8% AUM per year ($25k-$100k deposits), 0.7% AUM per year ($100k+ deposits).

The alternative asset groups have varying fee structures based on the asset class and brand - e.g. The Ark Venture Fund charges a 2.75% management fee and an operation fee of 0.15% on top of that.

On the other hand, Composer has two pricing structures:

A free tier to build, backtest, and watch strategies.

A paid tier (Composer Pro) that charges a fixed fee of $24 per month (paid annually) or $30 per month (paid monthly) to create an unlimited number of automated trading bots. This also provides you with access to professional grade data to backtest with, an AI assistant to help you build your own strategies, real-time portfolio metrics, and weekly performance updates to keep a track of your investments.

One advantage of Composer is the flat fee that does not increase as your assets under management increase.

Brokerages & Deposit Security

Composer Securities LLC is a registered broker-dealer with the SEC and a member of FINRA / SIPC, and automatically creates an Alpaca brokerage account for you. This means you have exactly the $500k in deposit security through SIPC insurance.

Likewise Titan Invest is also a Registered Investment Advisor (SEC and FINRA regulated) and provides deposit security of $500k through SIPC insurance. The Titan Smart Cash account (cash management account) is also FDIC insured up to $250k. Brokerage services for Titan are handled by Titan Global Technologies LLC and Apex Clearing Corporation, both are registered broker-dealers and members of FINRA/SEC.

AI functionality

Titan Invest does not have a dedicated AI-assistant and doesn't provide AI functionality.

Composer on the other hand has a ChatGPT4 AI copilot to supercharge the investing process. Using ChatGPT you can create strategies from scratch by ask questions and telling the AI assistant what you want For example: Can you create a retirement strategy with a focus on long term bonds and gold? What are the risks of this strategy? What should I add to diversify this strategy? What type of strategy would be a good complement to this one? You can check out more details here.

Customer Support

Composer offers email, live chat, and zoom calls with the product team. This means you have direct access to help influence how the product is improved going forward.

Titan Invest also offers email and in-app support channels.

Final Remarks

Titan Invest and Composer have two very different value propositions. If you’re looking for a roboadvisor platform where you can select into a variety of pre-built products, Titan Invest may be a better fit.

If you’re looking for a more sophisticated trading platform that let’s you build trading algorithms from scratch (without coding) as well as find pre-built strategies to invest in, Composer may be the better fit due to the flexibility.

Moreover, building strategies in Composer is a fun activity, and spending time doing so is a great way to get accustomed to how the no-code editor works.

As you do so, we invite you to explore the site and sign up for a free Composer account to get a first-hand impression of what our platform can do for you.

We'd be happy to have you on our side, and provide you with the best automated stock trading platform there is!

Important Disclosures

Investing in securities involves risks, including the risk of loss, including principal. Composer Securities LLC is a broker-dealer registered with the SEC and member of FINRA / SIPC. The SEC has not approved this message.

Certain information contained in here has been obtained from third-party sources. While taken from sources believed to be reliable, Composer has not independently verified such information and makes no representations about the accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; Composer has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, as it was prepared without regard to any specific objectives, or financial circumstances, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not intended as a recommendation to purchase or sell any security and performance of certain hypothetical scenarios described herein is not necessarily indicative of actual results. Any investments referred to, or described are not representative of all investments in strategies managed by Composer, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see Composer's Legal Page for additional important information.